Indiana homeowners frequently experience sticker shock when January utility bills arrive following the holiday season. The combination of increased winter heating costs and elevated seasonal energy consumption creates a perfect storm of post-holiday expenses. Understanding how to calculate the return on investment for insulation upgrades can transform this annual financial burden into an opportunity for long-term energy cost savings and improved home comfort.

The Department of Energy estimates that inadequate insulation and air leakage account for 25-30% of residential energy consumption. For Indiana homes facing harsh winter conditions, the impact on heating bills can be substantial. Evaluating thermal efficiency improvements through proper insulation installation provides a strategic approach to reducing utility costs while simultaneously increasing home value and achieving meaningful energy waste reduction throughout the year.

Indiana Energy Bills Create Urgency for Home Improvement ROI

Major Indiana utility companies including Duke Energy Indiana, AES Indiana, Northern Indiana Public Service Company, and Vectren report significant winter energy usage spikes. Natural gas prices and electricity rates fluctuate, but the thermal performance of your building envelope remains the primary factor controlling heating system efficiency. Comprehensive home energy assessment reveals where heat loss occurs most dramatically, identifying priority areas for cost-effective improvements.

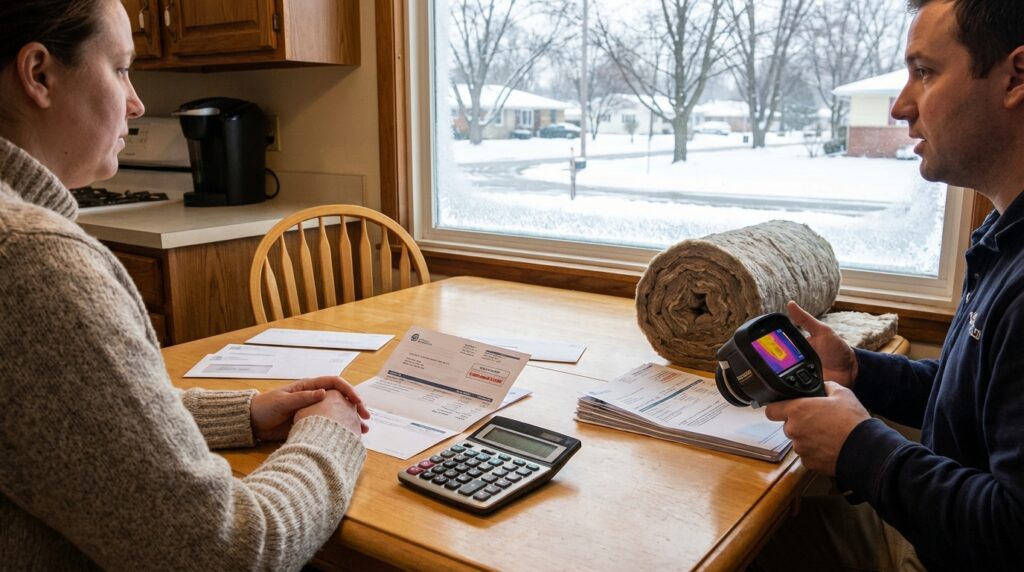

Thermal imaging and blower door test technologies enable insulation contractors to pinpoint specific locations where air infiltration reduction will yield maximum utility bill reduction. Attic insulation, wall insulation, basement insulation, and crawl space treatments each contribute differently to overall thermal resistance. Understanding which areas provide the fastest payback period helps homeowners prioritize weatherization services based on available budget and expected energy performance improvements.

Insulation ROI Calculations Incorporate Multiple Cost Savings Factors

Calculating return on investment for insulation upgrades requires analyzing both immediate utility bill reductions and long-term property assessment benefits. Energy Star recommendations suggest documenting current heating costs and cooling costs as baseline measurements. Most Indiana homeowners see 15-30% reductions in monthly energy bills following comprehensive insulation installation, with actual savings varying based on existing R-value, home size, and HVAC system efficiency.

The payback period for residential insulation typically ranges from 2-8 years depending on material selection and installation scope. Spray foam insulation commands higher upfront costs but delivers superior air sealing benefits compared to fiberglass insulation or cellulose insulation. Professional home energy optimization assessments provide detailed projections specific to your property, accounting for Indiana climate considerations and current energy expenditure patterns.

How Do Different Insulation Materials Compare for Indiana Climate?

| Insulation Type | R-Value per Inch | Average Cost per Sq Ft | Typical Payback Period |

|---|---|---|---|

| Fiberglass Batts | 3.2-3.8 | $0.40-$0.70 | 3-5 years |

| Blown-In Cellulose | 3.2-3.8 | $0.60-$1.20 | 4-6 years |

| Spray Foam (Open Cell) | 3.5-3.6 | $1.20-$2.00 | 5-7 years |

| Spray Foam (Closed Cell) | 6.0-7.0 | $2.00-$3.50 | 6-8 years |

Indiana Energy Programs Accelerate Insulation Investment Returns

Federal tax incentives and Indiana energy programs significantly improve insulation upgrade ROI calculations. The Energy Efficiency Home Improvement Credit allows qualifying homeowners to claim up to 30% of insulation costs, with maximum annual credits of $1,200 for qualifying improvements. Additionally, energy efficiency rebates from Indiana utility companies provide direct financial incentives that reduce net installation expenses and shorten payback timelines.

Duke Energy rebates, AES Indiana programs, NIPSCO energy savings initiatives, and Vectren efficiency programs each offer specific weatherization incentives. The Indiana Utility Regulatory Commission oversees these programs to ensure accessibility for residential customers. Combining multiple incentive sources can reduce effective insulation costs by 20-50%, dramatically improving return on investment calculations and making professional insulation service more affordable for budget-conscious homeowners recovering from holiday spending.

What Incentives Are Available for Indiana Home Insulation Projects?

- Federal Energy Efficiency Tax Credit covering up to 30% of qualifying insulation materials and installation labor

- Utility company rebates ranging from $100-$1,000 depending on project scope and energy savings verification

- Low-interest financing through home weatherization programs administered by local community action agencies

- Property tax exemptions in certain Indiana municipalities for documented energy efficiency improvements

Thermal Efficiency Improvements Deliver Year-Round Home Comfort Benefits

Beyond utility bill management, proper insulation installation enhances temperature regulation throughout all seasons. Summer cooling efficiency improves as thermal barriers prevent heat infiltration, reducing air conditioning savings and extending HVAC equipment lifespan. Draft elimination creates more consistent indoor temperatures, eliminating cold spots near windows and exterior walls that compromise comfort during Indiana’s frigid winter months.

Air sealing combined with adequate vapor barrier installation prevents moisture infiltration that can damage building materials and reduce insulation effectiveness over time. Comprehensive building envelope improvements address both thermal resistance and air leakage simultaneously, maximizing energy conservation results. Professional insulation contractors understand how different components work together to create optimal thermal performance, ensuring installations meet Department of Energy recommendations for Indiana’s climate zone requirements.

Frequently Asked Questions

How quickly will new insulation reduce my Indiana heating bills?

Most Indiana homeowners notice utility bill reductions within the first complete billing cycle following insulation installation. The magnitude of savings depends on existing insulation levels, home size, and heating system efficiency, but typical reductions range from 15-30% on monthly heating costs during winter months and 10-20% on cooling costs during summer.

What R-value insulation do Indiana homes need?

The Department of Energy recommends Indiana homes in Climate Zone 5 maintain R-49 to R-60 in attics, R-13 to R-21 in exterior walls, and R-25 to R-30 in floors above unheated spaces. Existing homes often fall short of these standards, making insulation upgrades particularly cost-effective for improving energy performance and thermal comfort.

Should I conduct an energy audit before installing insulation?

A professional home energy assessment using thermal imaging and blower door testing identifies specific areas where insulation upgrades will deliver maximum ROI. This diagnostic approach prevents wasting money on improvements that won’t significantly impact energy bills, ensuring your insulation investment targets the most critical heat loss locations in your home’s thermal envelope.

How does new insulation affect Indiana home resale value?

Energy-efficient homes command premium prices in Indiana’s real estate market. National Association of Realtors data indicates comprehensive insulation upgrades typically return 95-100% of installation costs through increased property assessment values, while simultaneously making homes more attractive to buyers concerned about ongoing utility expenses and environmental impact.